Liquidity Provision

Liquidity Provision is the most important part of RateX. Liquidity Providers deposit YBA as collateral to mint synthetic YT and ST, and builds a time-decaying AMM model.

LP Structure Breakdown

RateX’s LP mechanism allows users to deposit yield-bearing assets (i.e., assets that can generate returns), and generates YT and ST for trading using a Uniswap V3 like AMM. The process of generating YT and ST is as follows:

The LP deposits a yield-bearing asset, similar to putting money into a bank.

1. The RateX system generates ST for the LP, representing the current value of the yield-bearing asset.

2. The system also generates some YTs for the LP, representing potential future yield (RateX gives LPs a credit to issue YT based on the ST they hold and its future earnings. The maximum amount of YT they can issue is decided by a parameter called the AR-Coefficient.).

3. Finally, the LP creates a trading pair with the generated YT and ST for other traders to exchange.

RateX LPs earn yield from three main sources:

The yield generated from STs and PTs

Rebates on trading fees

PnL from acting as counterparties. (The latter mainly comes from the price difference when YTs are traded and the future yield flow the LPs receive from holding YTs.)

Since YT’s value is typically small and tends to approach zero over time, the PnL from acting as counterparties is minimal compared to the overall LP amount and can be nearly negligible compared to the yield from yield-bearing assets and trading fee rebates.

Key Features of the Liquidity Provision Mechanism

1. Time-Decaying Impermanent Loss: As the AMM’s value diminishes over time, its share of the total value in the liquidity pool gradually approaches zero. This reduces the potential impermanent loss for LPs in expiring contracts, eventually eliminating it.

2. AMM Rebalancing: Because the value of YT decreases with each yield payment, the amount of ST in the AMM must be adjusted accordingly. The AMM rebalances itself based on the new value of YT.

3. Liquidity Concentration: RateX’s YT/ST uses Uni.V3’s liquidity concentration mechanism, which enhances the efficiency of liquidity provision.

Risk Rewards Analysis for LPs

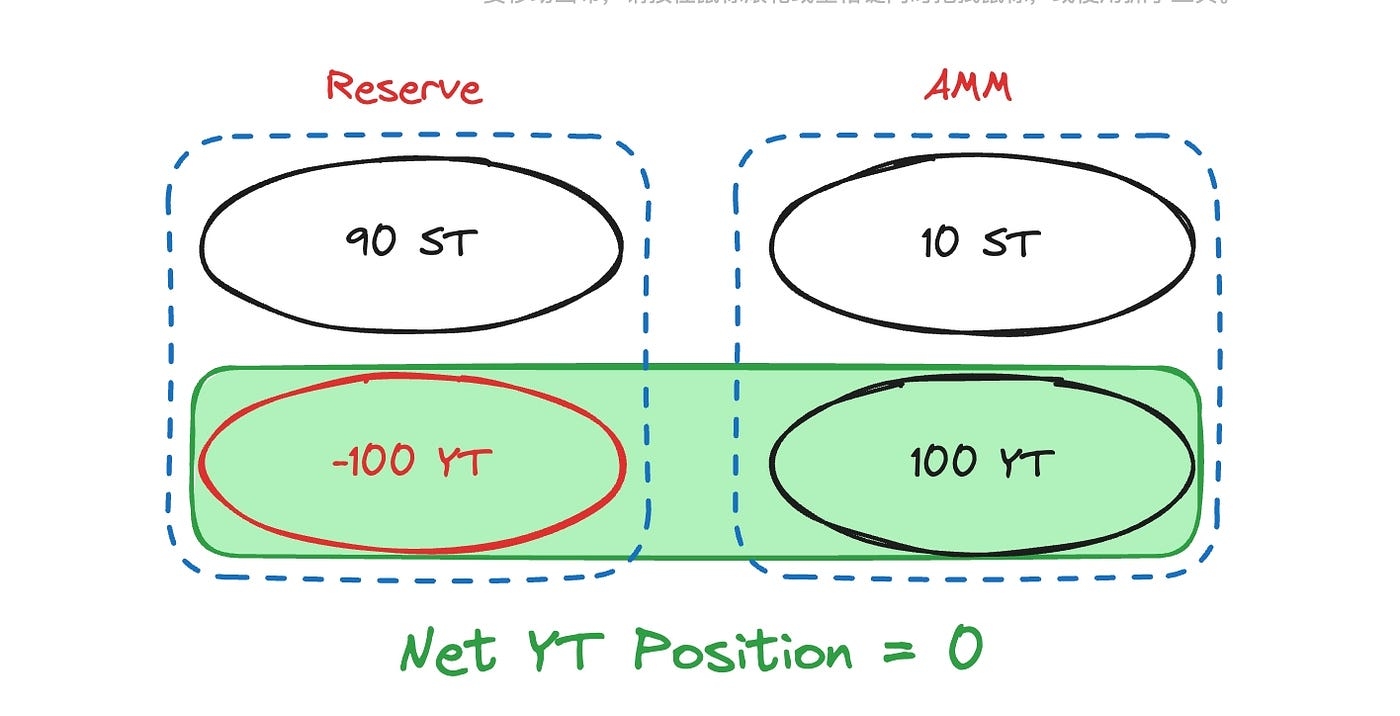

When an LP deposits assets and generates ST and YT, the LP holds a combination of 1 ST and 1 YT (while also bearing the obligation to pay out YT returns). If no trades occur, the LP simply holds ST, which is the original asset.

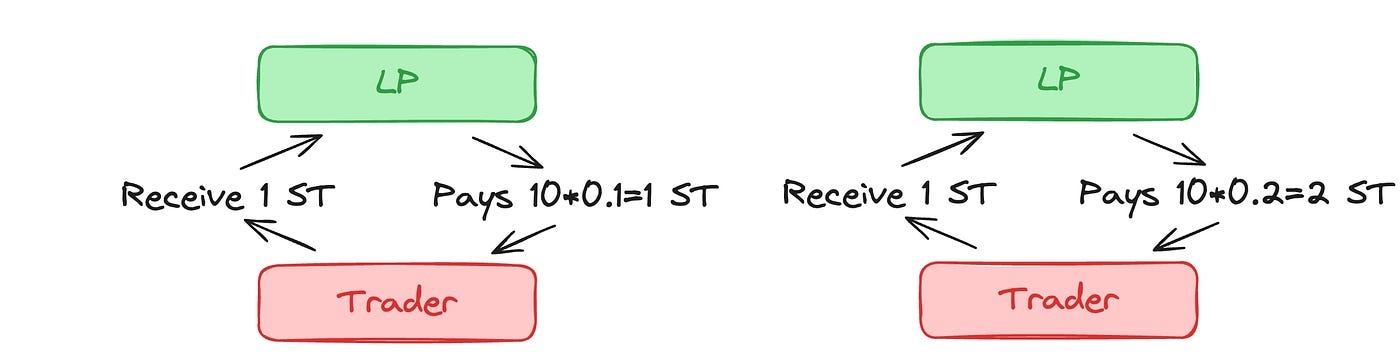

If traders exchange ST for the LP’s YT, the LP’s YT holdings decrease, but the LP still has an obligation to pay YT holders a certain amount of ST as yield. In this case, the LP uses the ST received from selling YT to meet these obligations. If the market price is reasonable, the amount of ST the LP receives and the amount it needs to pay are equal, allowing the LP to retain its original ST and its yield as profit. If market pricing is less favorable, the LP may need to pay more or less ST.

**For example:**

Suppose we have a 1 year contract, and 1 YT is priced at 0.1 ST, with implied yield 10%. When an LP deposits 100 yield-bearing asset(which generate 100 ST), their net YT position is 0. If the actual yield is 10% and LP hold to maturity, it can receive 110 ST+fee rebates.

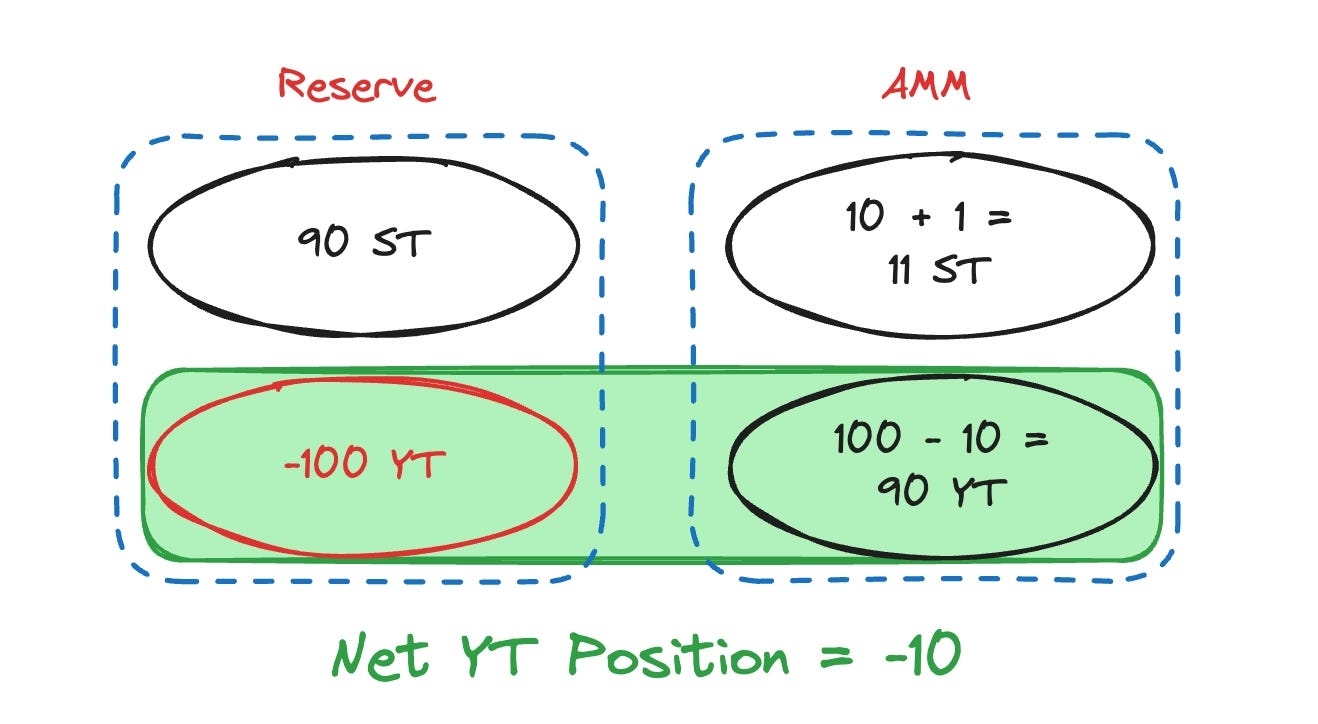

If a trader spends 1 ST to buy 10 YT, the LP’s YT position changes. At this point, the LP receives ST and has an obligation to pay the corresponding ST for the YT.

If the amount of ST the LP needs to pay is equal to the ST received, there is no profit or loss. And the LP will receive 110 ST + rebates when maturity.

If the LP needs to pay 2 ST in returns (which means the actual yield is 20%), it means the trader earned 1 ST, and the LP earned 1 ST less. So, the LP will receive 119 ST =120 ST — 1 ST plus rebates on trading fees when maturity.

Even if all the YT is traded at zero cost, the LP can still meet its YT obligations through future returns from ST while keeping the deposited asset and transaction fees earned during trading.

Risks for LPs:

1. Liquidity Risk: LPs need to close their YT positions in the market before withdrawing their deposited YBA. If the slippage settings are too tight or if the AMM lacks sufficient YT or ST liquidity, LPs might not be able to fully close their YT positions, which could prevent them from withdrawing the full amount.

2. Potential Impermanent Loss: Since LPs provide YT liquidity to the AMM for market making, they may face some losses if YT prices fluctuate or if the actual yield of the YBA deviates from the market’s implied yield during market making. However, these losses are typically minor, as the value of YT is relatively small compared to the value of the deposited YBA.

3. Socialized Loss: If you provide liquidity to a contract supporting margin yield trading, in cases of large-scale liquidations where both the insurance fund and ADL (Auto-Deleveraging) are unable to fully absorb the liquidated positions, LPs will act as the ultimate backstop and take over these positions.

Last updated